FAQs

When a transaction exceeds a default amount set by AYA Bank is debited to your bank account or credited from your account, you will receive a SMS Alert. AYA SMS Alert notifies the suspicious acitvities in order to prevent fraudenlent and secure your bank account information and your privacy.

If you have an AYA saving and current accounts, you can subscribe to our SMS Alert. You will also need a mobile phone number that can receive SMS.

Yes, the alert associated with account will be closed together with the account.

Please kindly sign-up at nearest AYA Bank branch.

You need the followings.

For Existing Customer

(Individual)

- NRC Number

(Corporate)

- BOD Resolution (Meeting minutes)

- Only authorized person can apply

For New Customer

- If individual, need to open new account and apply SMS Alert Service.

- If corporate, follow corporate account opening process and apply SMS Alert Service.

The process may take approximately 3 working days in order to get access SMS Alert Service.

Yes. It is eligible to all telecommunications operating in Myanmar.

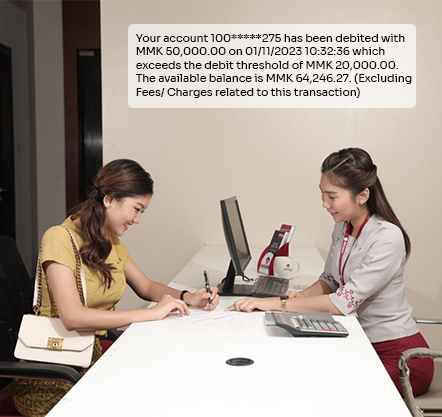

A SMS Alert will be sent to your registered phone number, immediately after every debit and credit transaction which is above 20,000 Kyats from your account.

Eg: ATM Withdraw, Deposit with cash/cheque, POS Transaction, Mobile Banking/ Internet Banking Bill Payment Transaction, Money Transfer, online shopping, etc.

The charges collection is the post-paid model which will debit 1500 Kyat for Individual Account), 3000 Kyat for Corporate Account from the given account on the monthly anniversary date of the registration. In the case of insufficient funds on the date of debiting from the account, the bank will charge (2) months service charges on the debit day of the following month. If the account has no sufficient funds for two consecutive months of debiting, SMS Alert Service will be terminated.

This service is not available until further notice from the bank.

The SMS Alert may be delayed due to circumstances beyond the Bank's control as it is telco-dependent. Please also ensure that your mobile number is updated in the Bank's records and you have made all debit and credit transactions above 20,000 Kyat in order to receive continuous SMS Alerts from the Bank.

You can terminate your subscription by visiting nearest AYA Branches in one month advance with NRC and fill up the termination request in SMS Alert Service Application Form.

For security concerns, please call our Customer Service Hotline at 01-23 17777 for clarification on the alert that you received. For Royal Customers, please contact your Relationship Manager.

In case of the damage, loss of the mobile contact number that is subscribed to SMS Alert Service, the applicant must inform AYA branch immediately. At any AYA Bank Branch, you may update your mobile phone number by completing the change of SMS Alert Service Application Form and presenting your NRC.

You may link all your deposit accounts to your particular phone number.

However, charges are 1500 Kyats per account for Individual and 2,000 Kyats per account for Corporate.